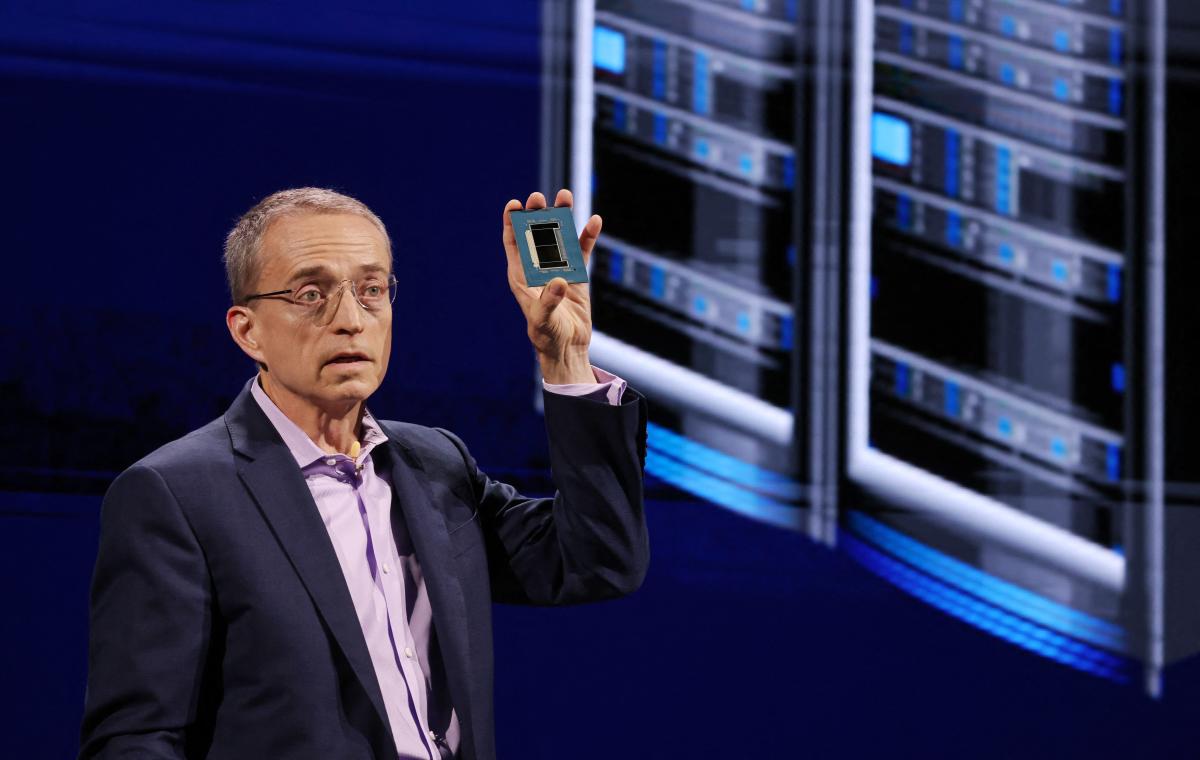

Despite Intel’s recent troubles, I wasn’t expecting to see it CEO Pat Gelsinger joins 15,000 of his colleagues being shown the door. Gelsinger is a storied engineer and business success who laid out a comprehensive rescue plan when he took over at the beleaguered chipmaker in 2021. It was never going to be a quick fix, given the company’s long legacy of missteps. company Gelsinger may be the public face of Intel’s current malaise, but the problems began long before his tenure and will likely continue.

How Intel got here

Gelsinger was tasked with addressing nearly two decades of bad decisions, all of them compounded. Intel became an industry giant as half of the Wintel Allianceproducing chips that went hand in hand with Microsoft Windows. The huge profits that flowed from this partnership meant that there was an institutional reluctance to look at too many new businesses that might distract from their golden goose, which was still going strong all these years later.

In 2005, then CEO Paul Ottellini declined the opportunity to make the iPhone’s system-on-chip. It would have been easy for Intel since it already made XScale ARM chips for mobile devices. You could find an Intel ARM chip inside popular phones like the BlackBerry Pearl 8100 and the Palm Treo 650. A year later, it would sell XScale to Marvell, believing it would be able to shrink its x86 chips to work in smartphones. The Early Intel Atom phones showed some degree of promisebut the Snapdragons of the day, produced by considerably smaller rival Qualcomm, beat them quite easily.

At the same time, Intel was working on Larrabee, its own discrete GPU platform based on the x86 architecture. Despite several years of marketing bravado and suggestions, I would “kill” AMD/ATI and NVIDIAIntel dropped it in 2010 in favor of bundling integrated graphics into its mainstream processor products. The decision would hand the majority of the GPU market to NVIDIA, making it the go-to name for gaming, supercomputing, crypto and artificial intelligence, with quarterly revenue of 35.1 billion dollars on November 20.

Could Intel have predicted the meteoric rise of AI? Maybe not. But Reuters reported that former Intel CEO Bob Swan turned down an opportunity to invest in OpenAI in 2017. He was looking for a hardware partner to reduce his reliance on NVIDIA, offering a generous deal in the process. Swan, however, said he could not see a future for generative AI, and Intel’s data center unit refused to sell the hardware at a discount.

Intel’s core strength was in the quality of its engineering, the solidity of its product and that it always stayed close to the cutting edge. (There are parallels between Intel and Boeing, which are seeing their reputation for quality erode in real time.) Unfortunately, Intel’s bread-and-butter business suffered after the company failed to produce chips of 10 nanometers with its expected deadline of 2015. The company’s famous “tick, tock” strategy of releasing a new chip process one year and a refined version the next is stopped.

These problems allowed Intel’s competitors to step in and steal a march, taking advantage of more modern chip architectures. AMD, which held out a bit 10 percent of the chip market for much of the 2010s, it has seen some market share doubled in recent years. The biggest beneficiary, of course, was TSMC, the Taiwanese chipmaker that has become the envy of the world. While Intel controls most of the x86 processor market, it’s TSMC that makes chips for Apple, Qualcomm, NVIDIA and AMD, among others. Meanwhile, Intel was saddled with an older chip-making process it couldn’t use to catch up with its rivals.

The Gelsinger doctrine

Gelsinger was as close to an Intel “perpetuity” as you’d imagine, joining the company at age 18 and rising to the position of chief technology officer in 2001. In 2009, he left Intel to become became COO at EMC and held the position of CEO of EMC. VMWare for nearly a decade. After taking the reins of Intel, he laid out a detailed plan to lead its glorious comeback.

The first step would be to separate Intel’s design and manufacturing business two distinct entities. With one eye on US subsidies through the Biden administration’s Science and CHIPS Act, Gelsinger committed to building two new chip factories leveraging the same EUV (Extreme Ultraviolet Lithography) technology used by TSMC.

Gelsinger was also determined to restore discipline in Intel’s chip business and return to the “tick, tock” structure. Unfortunately, the production delays that had been piling up since 2015 meant that Gelsinger’s goal was just to get back to parity. Meanwhile, Intel would also get TSMC to make some of its newest chips, which, while expensive, would help address any concerns that the company would fall further behind.

No one was in any doubt about the enormity of the task facing Gelsinger, but there was plenty of room for optimism. Gelsinger was humble enough to accept that Intel could not simply stay on its current course and had to accept its new status. He proposed that Intel could grin and bear the short-term pain for the company’s bottom line. If it could build for the future, leverage its rivals to keep it in the game, and restore faith in its processes, Intel would emerge from this as the winner. It just needed nothing to get worse.

Things got worse

At the end of October, Reuters reported that Gelsinger made a colossal mistake when talking about TSMC. The CEO was quoted as saying, “You don’t want all our eggs in the basket of a factory in Taiwan” and that “Taiwan is not a stable place.” This offended TSMC so much that it ended a discount that Intel had taken advantage of for years

Unfortunately, Gelsinger’s desire to restore discipline to the chip division would also backfire, with the latest Core processors plagued by voltage instability problems. Intel was forced extend the guarantees of these chipswhich was an additional cost that really could not be afforded. In August, it posted a loss of $1.6 billion and pledged to cut 15,000 employees to try to right the ship. But he was forced records the biggest quarterly loss in its history three months later, losing $16.6 billion, though much of that is related to revaluing the company’s assets and paying for layoffs. Even worse, Intel’s new production process, the 18A, is called failed crucial tests ahead of its 2025 debut.

Perhaps the lowest point of Intel’s year was when its stock price fell enough to make it a takeover target. Rumors suggested that Qualcomm was potentially expecting a takeover while others indicated ARM had made inquiries about buying Intel’s product unit.

Where does this leave Intel?

The New York Times reports that Intel’s board became frustrated with Gelsinger because his rescue plan “wasn’t showing results fast enough.” But Intel wasn’t going to hire Gelsinger in 2021 and suddenly be back in 2024. Building large, complex chip factories isn’t easy. Nor is it getting thousands of engineers to solve difficult problems around chip performance. And of course, reversing a slide that began in 2015 would never happen overnight.

Intel’s board is currently looking for a full-time successor to Gelsinger, but it’s hard to see what anyone else would do differently. After all, the company still needs to build these factories to own and control its future, and it still needs to fix its processes. Unless, of course, the next CEO is told to just stop the bleeding and keep the money flowing. Even in its deeply wounded state after a few bad quarters, Intel is still the biggest name in the x86 chip world and will continue to make money for years to come.

You could easily imagine Intel’s board sitting back, prioritizing a few years of healthy profits at the expense of the company’s long-term future. It can continue to sell modified versions of its existing desktop chips, ceding technology leadership to AMD, Qualcomm and others. There are probably a decade or two of large industrial customers who would be happy with Intel processors for their hardware as long as they still use Windows. Perhaps that would be appropriate given how big and ossified Intel has become, admitting that it can’t move fast enough to evolve.

This scenario is unlikely to be allowed given Intel’s larger role in the global technology space. Even if the incoming administration criticized the CHIPS Act, Intel will still be theirs largest recipient of funding — Having a domestic manufacturer on the scale of Intel will be an asset that few sane governments would allow to fall. But just changing CEOs won’t suddenly solve the company’s big, hard-to-solve problems. It wasn’t Pat Gelsinger who botched the power design for Raptor Lake, nor did he pass up the opportunity to make the iPhone CPU all those years ago. The TSMC stuff, it may be, but while a CEO sets the direction of travel, he can’t micromanage every process in a company of Intel’s scale. So whoever replaces him will have the same big pile of problems to tackle, knowing that the board’s patience will be even shorter this time around.