Cyber security experts have uncovered a credit card breach that threatens to disrupt the system Christmas buying millions of Americans.

Leakd.com researchers discovered the vulnerability Amazon Web Services (AWS) ‘S3 container’ used as a decoy, however the attackers left it open on the Internet.

The S3 bucket is a folder where companies store customer information, but this time it contained the credit card details, names, addresses and emails of five million people who were affected by fake advertising companies, including free rights. iPhone.

Experts urged people to contact their financial services providers because the information disclosed could pose a threat of fraud, illegal transactions, and identity theft.

While the party or parties with fraudulent credit card information is still unknown, Amazon’s AWS Abuse team is investigating.

Leaked.com said the perpetrators may have been involved in phishing: a technical scam in which criminals use fake emails, phone calls or websites posing as a reputable company to trick someone into providing personal information.

‘While it is unclear how long this data has been online, it is now a threat disrupting the holiday shopping season for potential victims also,’ cybersecurity researchers on a technology website warned.

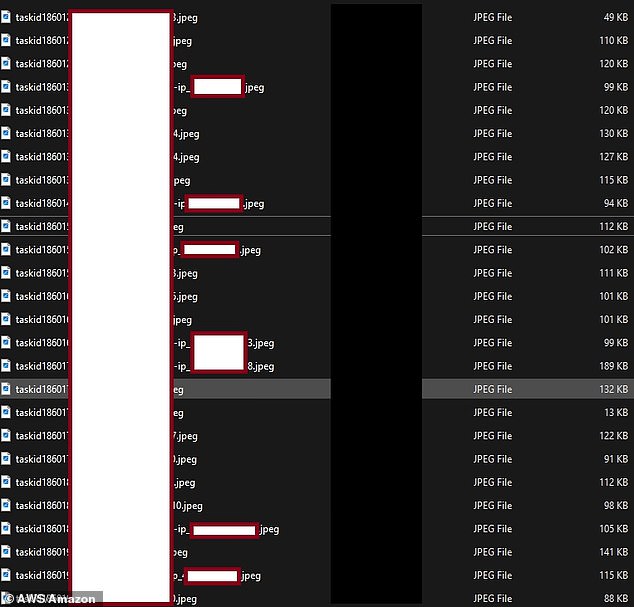

Amazon’s unsecured cloud storage site has left confidential information tied to nearly 5 million US credit cards exposed to malicious players everywhere on the Internet. Above, one of the 44 million images with classified information (edited for publication) found by Leakd.com

Team at Leakd.com discovered that the scam included multiple fake offers to ‘Win an iPhone 14’ from a company called ‘Braniacshop.’

‘On the dark web, a credit card, loaded with information, is worth about $17,’ the researchers said.

‘(So) with 5 million unique US credit and debit cards exposed in this breach, the monetary value of the stolen data exceeds $85 million.’

Cybersecurity experts at Leakd.com say the holiday season is a great time to be mindful of fake giveaways and be wary of overpriced holiday gifts.

‘Millions of Americans,’ they said, ‘may find their Christmas in jeopardy.’

The first thing you’ll want to do is start monitoring your credit card, online banking and other major financial statements for signs of suspicious activity.

Notify your bank, credit card issuer or other services if you see anything unusual as soon as possible, so they can stop using any affected cards.

Experts say the perpetrators may have been involved in phishing: a technical scam in which criminals send emails, phone calls or fake websites pretending to be from a reputable company to trick someone into providing personal information. Above: credit card

The Leakd.com team reported that the scam included multiple fake offers to ‘Win an iPhone 14’ from a company called ‘Braniacshop.’

If you want to stay organized, many financial institutions offer the option of setting up ‘cheat accounts’ that will help you manage this area in the middle of your busy life.

Setting up a ‘debt block’ can also help prevent cases where a fraudster is taking out loans in your name from financial companies you may not have known were there, offering loans or other forms of credit.

There’s no time to reset like now added security measures that are already part of the company’s security systemsuch as multi-factor authentication, long passwords and encrypted password managers.

Investing in any of the The best anti-theft reviews it doesn’t hurt, especially with many insurance providers that can recover money lost due to fraud and changing illegal purchases.

These services are especially useful if you are sharing bank accounts with your loved ones – whether they are a teenager, an elderly parent or a spouse who is not very smart or tech savvy.