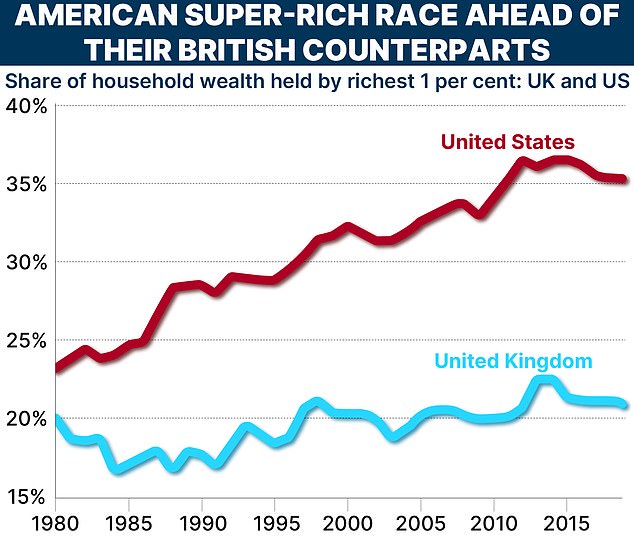

While the US has seen a sharp rise in wealth inequality over the past 40 years, Britain has not, according to analysis by the Resolution Foundation.

This is despite doubling the current household wealth in England, according to published research by leftist thinkers this week.

In Britain, the share of the top 1 percent of household wealth has risen by over one percentage point since 1980.

Instead, the ‘super-rich’ in the US grabbed another 12-point share in parallel, say Simon Pittaway and Tom Clark, of the Resolution Foundation.

‘Whether you look at the top 1 percent of all wealth, the top 10 percent, summary statistics like the Gini (a statistical measure of income inequality), wealth inequality is flat as a pancakes’, Pittaway and Clark add.

Pacific: In Britain, the share of the top 1 percent of household wealth has risen by over one percentage point since 1980. The opposite is true in the US

In 2006, the average property value for an adult in the top ten was £1.1million more today than for someone in the middle.

‘Today, despite the fall in aggregate assets as interest rates rise, that gap has grown to £1.3million’, the Resolution Foundation said.

The findings suggest that Britain’s biggest problem is not rising wealth inequality, ‘but rising wealth’, particularly in the context of the ratio between the value of assets of households and national income.

Pittaway and Clark said: ‘In recent years, this statistic has changed dramatically.

‘First, wealth rises to new heights in an epidemic. Interest rates have fallen to record lows, increasing house prices and increasing the “notional” value of pensions collected by increasing the capital required to purchase income. .

‘More recently, rising rates led to rapid turnover on both sides, at one point draining £2trillion from household assets.

‘Even through these recent ups and downs, a great trend remains: the asset-to-income ratio is almost double what it was in 1980.’

A £2.6trillion fall in total household wealth between the first quarter of 2022 and the last quarter of 2023. The shift in the value of pensions and the shift away from benefit schemes has identified contributed to this decline, the report said.

According to research, ‘greater wealth’ leads to greater global equality even if wealth inequality does not increase, because wealth is ‘always and everywhere more unequal than income: about twice as much.’

Wealth equality between age groups is increasing

The Resolution Foundation says that the headline holds that wealth inequality masks a very different picture.

It says inequality between age groups has widened, saying: ‘In 2018-20, median wealth among Britons in their 60s was 55 per cent higher than in of that year in the year 2006-08, but the middle goods for those. in their 30s it is a third (34 per cent) less.’

Looking at the period between the 2008 financial crisis and the pandemic, wealth in Britain became more disparate between young and old, according to the findings.

The fortunes of young and old are closely linked to home ownership characteristics, the Resolution Foundation said in its Freedom of Action report.

Between 2006 and 2008, the proportion of 35- to 44-year-olds who owned their homes was nearly 73 percent. Between 2018 and 2020, this figure will drop to 66 percent. In this age group, they are unlikely to get on the property ladder.

According to the Resolution Foundation, the opposite trend has been seen in older generations with rising home ownership rates targeting the bottom of the wealth distribution.

Wealth and inheritance look to continue the ‘great work of the past’ to shape the distribution of wealth among different age groups.