- Employers’ NI contributions increased by 1.2% with lower wages

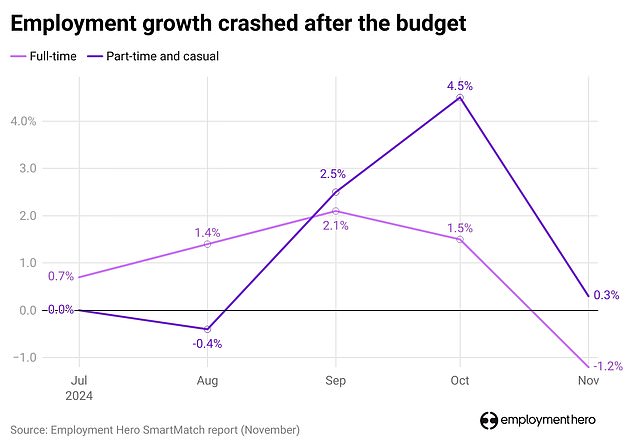

Bosses appeared to ‘match the Chancellor’s Budget’ by cutting staff, according to data from Employment Hero’s SmartMatch Pay Report.

Rachel Reeves’ £25billion National Insurance attack on employers has been criticized by some businessmen, with a 1.2 per cent increase per worker since April.

British businesses will also struggle to cope with the rise in the national minimum wage.

It was 1.2 percent in November, according to an Employment Hero poll of 90,000 workers, with young workers particularly affected.

The HR software firm said 4.8 percent fewer 18-24-year-olds were in full-time employment last month compared to October, in contrast to a 0.5 percent decline for 35-44-year-olds. .

Following data from the Bank of England on Thursday found that 54 percent of companies may have fewer employeesand wage hikes, in response to the Fall Budget.

Full-time jobs disappear in November – but seasonal jobs boost numbers

The bank’s figures also showed that 38 percent would pay lower fees, and 59 percent would absorb some of the penalties in the form of lower profits.

Employment Hero data showed a 0.1 per cent drop across all occupations and age groups, although this was offset by year-on-year pay which rose 0.3 per cent across all occupations part-time.

The data suggests that young full-time workers are more likely to lose their jobs

Employment Hero UK director Kevin Fitzgerald said: ‘These figures show that the negative decision on employment tax is already costing jobs.

‘The 4.8 per cent drop in full-time employment among 18-24-year-olds is particularly troubling, as it suggests employers are pulling back on bringing in new talent into their organizations.

‘We are seeing these job cuts months before the NIC rise comes into force – suggesting that firms are trying hard to protect their inventories.

‘While some workers may be able to switch to part-time jobs, this is not a permanent solution for the UK economy.

‘Government needs to reconsider this policy before it gets worse, especially for young people entering the workforce.’

DIY PLATFORMS Investing

AJ Bell

AJ Bell

Flexible and ready-made accounts

Hargreaves Lansdowne

Hargreaves Lansdowne

Free money making and investment ideas

interactive sender

interactive sender

Investment costs from £4.99 per month

Saxo

Saxo

Get £200 back on shopping fees

Trade 212

Trade 212

Free work and no deposit

Affiliate link: If you download a product This Money earns a commission. These prices are selected by our editorial team, because we think they are worth celebrating. This does not affect our independence.