Evernote Senior Partner Mark Mark Makhani explains why Netflix shares are a good investment, despite the competition for streaming competitors on “Varney & Co.”

Warner Bros. Discovery announced on Monday that split into two companies, separating their studios and streaming business From its cable television networks.

Mother’s company HBO and CNN is Split on two firms To help it better compete in the streaming, because it is expected to move the streaming unit WBD more than the cost scaling of the content without weighed from reducing cable networks in the company.

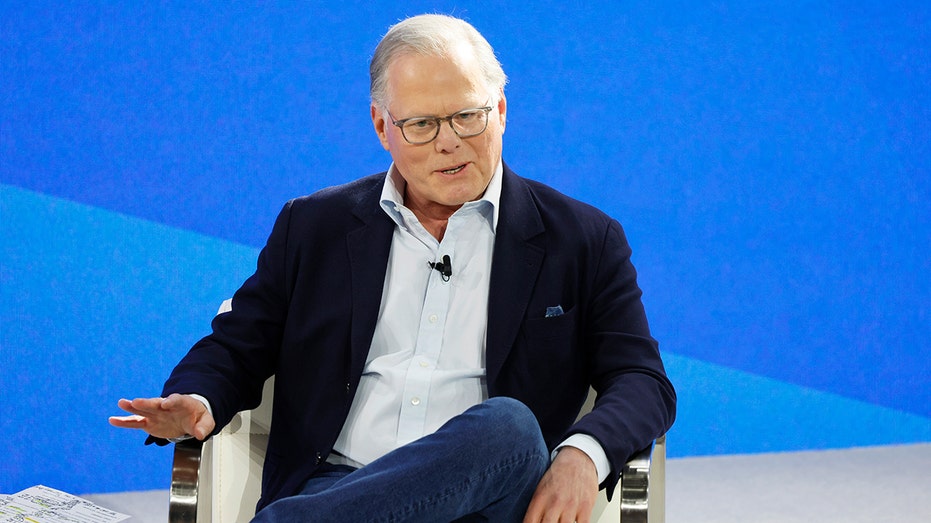

Discovery CEO of Discovery Bros. David has sent a broadcast business after the split, while the financial director Gunnar Wiedenfels will head the world network.

“By working as two different and optimized companies in the future, we expand these iconic brands with a tougher focus and strategic flexibility needed to compete most effectively in today’s media landscape,” said Zaslav.

“Senser Street” ink with Netflix

Warner Bros. Discovery will share its studio and streaming enterprise from its cable television networks in the agreement that will be completed next year. (Photographer: Yuki Iwamura / Bloomberg via Getty Images / Getty Images)

Corporate split occurs a few years after merger WarnerMedia and Discovery 2022 transaction without taxesWhich is expected to end by mid -2016.

During the morning bidding, WBD shares rose 8%.

Company laid the basis for potential sale or spinophus cable TV Assets in December when it announced the separation of its streaming and studies.

| Ticket | Safety | Last | Variation | Change % |

|---|---|---|---|---|

| Wbd | Warner Bros. Discovery Inc. | 10.61 | +0.79 |

+7.99% |

Disney reduces hundreds of television and movies amid expansion broadcast

The split will align the company with Comcast, which rotates with most of its cable television networks.

Bank Analyst Bank of America Jessica Reeph Erlich said cable TV assets Warner Bros. – This is a “very logical partner” for the new company Spinoff Comcast.

Disney provides new ESPN transfer service with a direct consumer with $ 299 price tag

Discovery CEO of Discovery Bros. David had announced a split. (Michael M. Santiago / Getti Image / Getti Image)

WBD also on Monday launched tender offers Restructuring existing debtThe $ 17.5 billion funded bridge provided by JPMorgan.

It is expected that the bridge loan will be refined to the planned separation, and the company added that the global networking department will retain up to 20% of the broadcast shares and the studios that plan to monetize to further reduce its debt.

Get the Fox Business on the go by clicking here

JPMorgan and Evercore advises WBD for the agreement, and Kirkland & Ellis performs the duties of a legal lawyer.

Reuters contributed to this report.